Failing to file tax returns leads to automatic penalties of Ksh 2,000 for individuals and Ksh 20,000 for companies.

Unpaid taxes attract a 5% penalty and 1% monthly interest.

Non-compliance blocks access to Tax Compliance Certificates, business tenders, and bank services.

Repeat offenders risk audits, legal enforcement, and blacklisting by KRA.

Backdated returns can be filed, and during amnesty windows, penalties may be waived.

What Happens If You Don’t File Your Tax Returns in Kenya

A Quick Recap of This Story

Introduction: Why Filing Matters

In Kenya, filing tax returns isn’t optional—it’s a legal obligation. Whether you're employed, self-employed, a business owner, or even jobless, if you have a valid Kenya Revenue Authority (KRA) PIN, you must file a tax return annually. Many people assume that if they didn’t earn any income, they can ignore the process. That assumption comes at a high cost.

The consequences of not filing tax returns go far beyond financial penalties. They include restricted access to vital services, damaged credit records, and potential legal enforcement. Here’s a detailed look at what actually happens when you skip this crucial responsibility.

Immediate Penalties for Late or Non-Filing

Once the June 30th deadline passes without a return filed, KRA’s system automatically flags your profile as non-compliant. This triggers the following penalties:

1.For Individuals:

-A Ksh 2,000 fine or 5% of the tax due, whichever is higher.

2.For Companies and Partnerships:

-A minimum penalty of Ksh 20,000 or 5% of the unpaid tax, whichever is higher.

These penalties are automatically computed and reflected in your iTax ledger. Even if you earned nothing during the tax year, failing to file a Nil return still attracts the Ksh 2,000 fine.

Accumulating Interest on Unpaid Tax

If you owe tax and fail to pay, the consequences compound:

-A 5% penalty is levied immediately on the unpaid tax.

-1% interest per month is added until the amount is settled.

This means the longer you wait, the more expensive it becomes to clear the debt. The unpaid tax amount grows each month, and eventually, you could face enforcement action to recover the dues.

Non-Compliance Status: A Hidden Barrier

Failing to file doesn’t just invite penalties—it also affects your compliance status, which has broader implications:

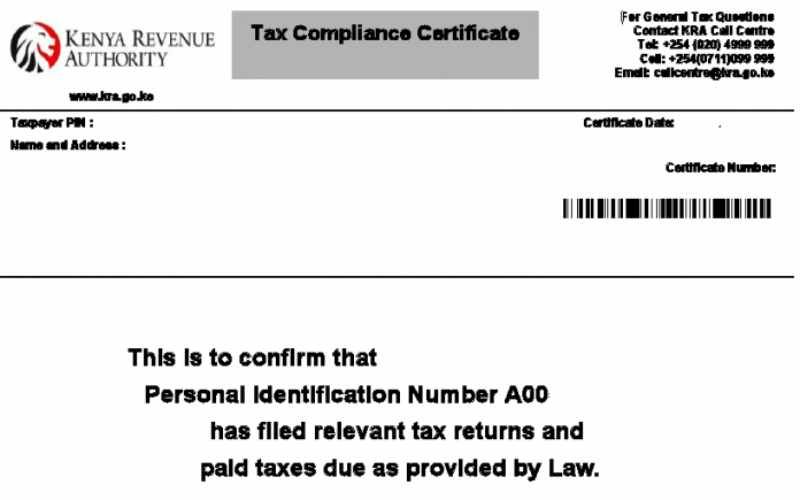

-You won’t be able to get a Tax Compliance Certificate (TCC)—a requirement for most government contracts, tender applications, and business registrations.

-You may face difficulties opening or maintaining bank accounts, particularly business or investment accounts.

-Visa applications and professional license renewals could be denied if proof of tax compliance is required.

-You risk being flagged for audits by KRA, especially if you’ve missed multiple filing cycles.

System Blacklisting and Legal Consequences

KRA uses data analytics and system integration to monitor filing compliance. If you’re flagged repeatedly:

-You could be blacklisted, meaning any future income or transactions you declare could be automatically subjected to tax scrutiny.

-KRA may initiate enforcement action: this includes issuing agency notices to your bank, garnishing your income, or instituting legal proceedings.

-In extreme cases involving large or persistent non-compliance, criminal charges could be filed, leading to court appearances or prosecution.

Impact on Businesses and Employers

For businesses, failing to file and remit taxes has severe consequences:

-You may be disqualified from government or county tenders.

-Your business risks suspension of trade licenses or regulatory approvals.

-Directors may be held personally liable for unremitted taxes, especially PAYE, VAT, or Withholding Tax.

-Your financial reputation suffers, affecting your creditworthiness and ability to raise funding.

What If You’ve Missed Multiple Years?

If you’ve missed filing for several years, all hope is not lost. You can file backdated returns through the iTax portal. KRA typically allows this, though penalties and interest will still apply. In some cases, like during tax amnesty windows, you may even qualify for waiver of penalties and interest—if you settle the principal tax due.

Final Thoughts: Silence Isn’t Golden

The myth that you can “stay under the radar” by not filing returns is dangerous. KRA’s systems are automated, cross-referenced with banks, NTSA, utility companies, and other public databases. The longer you stay non-compliant, the more costly and difficult it becomes to recover.

Filing your returns—even when you have no income—is an essential civic duty. It’s easier to stay compliant annually than to dig yourself out of a financial and legal mess later. The price of silence is far too high.

0 comments

Be the first one to comment, but before that...

Here are some best practices for writing comments: