Your Read is on the Way

Every Story Matters

Every Story Matters

The Hydropower Boom in Africa: A Green Energy Revolution Africa is tapping into its immense hydropower potential, ushering in an era of renewable energy. With monumental projects like Ethiopia’s Grand Ethiopian Renaissance Dam (GERD) and the Inga Dams in the Democratic Republic of Congo, the continent is gearing up to address its energy demands sustainably while driving economic growth.

Northern Kenya is a region rich in resources, cultural diversity, and strategic trade potential, yet it remains underutilized in the national development agenda.

Can AI Help cure HIV AIDS in 2025

Why Ruiru is Almost Dominating Thika in 2025

Mathare Exposed! Discover Mathare-Nairobi through an immersive ground and aerial Tour- HD

Bullet Bras Evolution || Where did Bullet Bras go to?

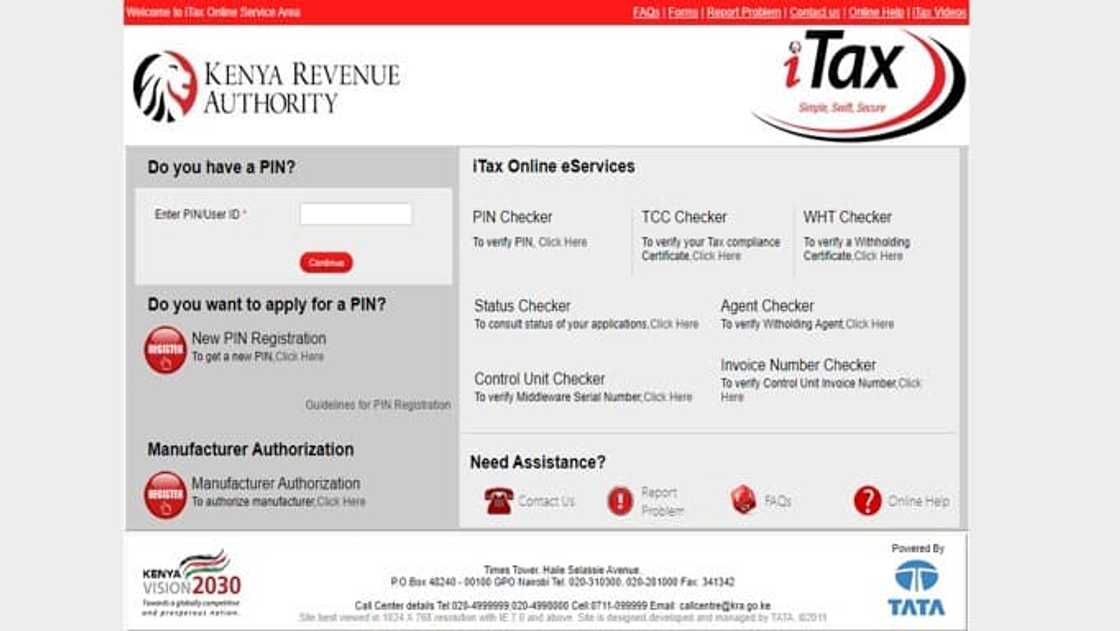

The Kenya Revenue Authority (KRA) has recently unveiled its plans to simplify the process of filing Pay-As-You-Earn (PAYE) returns for employers across Kenya. For years, businesses have faced a cumbersome and often confusing process to ensure they meet their tax obligations. The new initiative from KRA aims to overhaul this system and create a more streamlined, efficient filing process. With this change, KRA is not only responding to the frustrations expressed by employers but also working to enhance overall tax compliance within the country. The current filing system has often led to frequent errors, delays, and the imposition of penalties. By implementing this reform, KRA is hoping to eliminate these issues and create a more conducive environment for businesses, especially as they recover from the financial impacts of the pandemic.

The need for a simpler system is critical. Employers, particularly smaller businesses, have had to navigate complex tax regulations and adhere to numerous filing deadlines, leading to confusion and errors in filing. The complexity of these requirements has contributed to inconsistent tax payments, with some businesses inadvertently missing deadlines or failing to comply due to misunderstandings. KRA’s initiative aims to reduce these administrative burdens, making it easier for businesses to remain compliant, which, in turn, will help increase overall tax collection. This overhaul is poised to have a positive impact not just on large corporations but on the many small and medium enterprises (SMEs) that struggle with the current tax system.

The proposed changes to the PAYE filing system are designed to make tax compliance significantly easier for employers, both large and small. By simplifying the filing process, KRA aims to reduce the amount of time and resources that businesses need to spend on managing tax obligations. One of the key innovations introduced is automation, which will greatly enhance accuracy and efficiency. These changes are expected to make the entire process of submitting PAYE returns much quicker, more transparent, and far less prone to errors, benefiting both employers and KRA in the long term.

One of the most impactful changes is the introduction of automated data entry. Employers will be able to directly import employee payroll details into KRA’s system, eliminating the need for manual entry of tax data. This shift to automation ensures that the information submitted is far more accurate, reducing the risk of human error that can often lead to delayed filings or incorrect tax payments. By automating this process, KRA is making it easier for businesses to stay compliant without having to devote excessive time or resources to manual calculations. The new system will also include validation checks to catch any discrepancies before submissions, providing an added layer of protection for employers and ensuring that the data is in compliance with KRA’s requirements.

This approach will not only streamline the filing process but also significantly reduce the administrative burden that many businesses face. In the past, businesses had to manually input large amounts of payroll data into the tax system, which was not only time-consuming but also prone to errors. By shifting to a more automated approach, KRA is ensuring that employers can submit their PAYE returns more efficiently and with confidence that their data is correct. This automation also supports the government's broader push to digitize tax collection and make the entire process more modern and transparent.

In addition to automation, KRA is simplifying the forms used for PAYE returns. Historically, employers have found these forms complicated and overwhelming, which added to the stress of compliance. With the new system, the forms will be simplified with clearer instructions and fewer fields to fill out. This change will reduce confusion and make it easier for employers to provide accurate information. The updated forms will be designed to be user-friendly, so even those with limited experience with the tax process will be able to understand what is required of them.

Along with simplified forms, KRA is also re-aligning the deadlines for submitting PAYE returns. By better synchronizing the filing deadlines with payroll cycles, employers will have more time to prepare and submit their returns without the stress of approaching deadlines. This adjustment will allow for more flexibility, which is particularly beneficial for businesses with complex payroll structures or fluctuating employee counts. KRA is also considering options for filing extensions in cases of emergencies, further ensuring that employers have the support they need to comply without fear of penalties.

A significant portion of the reform will focus on upgrading KRA’s online portal, which is where employers will submit their PAYE returns. The new portal will be designed to handle bulk uploads of employee data, making it easier for employers to submit large quantities of information without encountering issues. In addition to the bulk upload feature, the portal will provide real-time feedback to employers on the status of their returns. This feature will allow businesses to track the progress of their filings and receive immediate notification if any issues arise. Furthermore, KRA is integrating a confirmation system that will notify employers once their returns have been successfully submitted, giving them peace of mind and ensuring that they meet their filing obligations.

The enhanced portal will also offer better accessibility for employers, with features designed to help them troubleshoot any issues they may encounter during the filing process. This could include detailed help sections, FAQs, and live chat support, making it easier for employers to find solutions and avoid common filing errors. This improved user experience is aimed at creating a more positive relationship between KRA and the businesses it oversees, reducing friction and building trust.

Recognizing that not all businesses are familiar with the intricacies of tax filing, KRA plans to roll out educational materials and training programs to guide employers through the new system. These resources will help businesses understand the changes being made, the new filing procedures, and how to navigate the enhanced online portal. KRA will host workshops and provide online tutorials to ensure employers are well-equipped to comply with the new system.

These educational resources will be available in multiple formats to ensure they reach a wide audience, from small businesses to large corporations. The goal is to empower employers to file their returns with confidence and accuracy, reducing the likelihood of errors and improving overall compliance.

In addition to formal training sessions, KRA will provide ongoing support to help employers adjust to the new system. This could include regular updates on any changes to tax regulations, reminders about upcoming deadlines, and tips for navigating the filing process. By offering these support services, KRA is ensuring that employers are not left to navigate the new system on their own and can get the help they need when they need it most.

As part of this overhaul, KRA is also introducing a more transparent and gradual penalty system. In the past, employers who made mistakes in their filings or missed deadlines were often subject to hefty fines, sometimes without warning. The new system, however, will offer employers the chance to correct errors before facing significant penalties. This approach aims to foster a more collaborative relationship between KRA and businesses, encouraging compliance without the fear of severe financial repercussions.

Employers who make genuine mistakes or experience difficulties filing will have the opportunity to make corrections without facing immediate, severe consequences. This new penalty structure is designed to encourage businesses to comply voluntarily and correct any errors as soon as they are identified, rather than discouraging them from filing at all due to fear of penalties.

These reforms are set to bring significant benefits to employers, especially those managing small and medium-sized businesses. By automating data entry and simplifying the filing process, businesses will be able to file their PAYE returns more quickly, accurately, and with fewer resources. The enhanced online portal, along with the availability of educational resources, will also help businesses navigate the new system with ease. In the long run, employers will not only save time but will also reduce the risk of penalties and fines due to the more automated and transparent system.

For smaller businesses, these changes will likely have a major impact, as they often face the greatest challenges when it comes to tax compliance. The introduction of bulk uploads and the integration of payroll systems with KRA’s platform will make the filing process less dependent on third-party accountants, allowing businesses to manage their own tax returns more efficiently. As a result, smaller businesses will have more control over their filings and a better understanding of their tax obligations.

0 comments