Your Read is on the Way

Every Story Matters

Every Story Matters

The Hydropower Boom in Africa: A Green Energy Revolution Africa is tapping into its immense hydropower potential, ushering in an era of renewable energy. With monumental projects like Ethiopia’s Grand Ethiopian Renaissance Dam (GERD) and the Inga Dams in the Democratic Republic of Congo, the continent is gearing up to address its energy demands sustainably while driving economic growth.

Northern Kenya is a region rich in resources, cultural diversity, and strategic trade potential, yet it remains underutilized in the national development agenda.

Can AI Help cure HIV AIDS in 2025

Why Ruiru is Almost Dominating Thika in 2025

Mathare Exposed! Discover Mathare-Nairobi through an immersive ground and aerial Tour- HD

Bullet Bras Evolution || Where did Bullet Bras go to?

The U.S. stock market is experiencing notable turbulence as investors react to the anticipation of new tariffs set to be announced by President Donald Trump. Major indices have seen significant declines, with the Nasdaq Composite dropping over 2%, marking a six-month low, and the S&P 500 falling more than 1% to its lowest point since September.

These declines come as market participants fear that the latest round of tariffs will further strain economic growth, raise costs for companies, and heighten inflationary pressures. As the deadline for the tariff implementation nears, Wall Street is closely monitoring how businesses and consumers might be affected.

The technology sector has been particularly impacted by the current downturn. Nvidia's stock, for example, fell by 5.1% to $104.27, contributing to an 18% decline since the start of the year. This downturn is partly attributed to the underwhelming IPO of CoreWeave, an AI company heavily reliant on Nvidia chips. The broader market’s apprehension about the forthcoming tariffs has also led to a sell-off in major tech stocks, including Tesla, Apple, and Microsoft.

While some investors see this as a temporary correction, others worry that prolonged trade disputes and increased costs for imported components could dampen growth in the tech industry. Companies that rely on global supply chains, particularly those importing materials from China, are expected to feel the most pressure if the tariffs go into effect as planned.

The uncertainty surrounding U.S. trade policies isn’t just affecting domestic markets; global markets are also seeing declines. European indices, including the STOXX Europe 600 and Germany’s DAX, have experienced downturns, while Japan’s Nikkei 225 and South Korea’s KOSPI have also fallen.

Investors in Asia and Europe are concerned about the potential ripple effects of U.S. tariffs on international trade. Many multinational companies with significant exposure to the American market are adjusting their forecasts, and supply chain disruptions could cause additional challenges for global businesses.

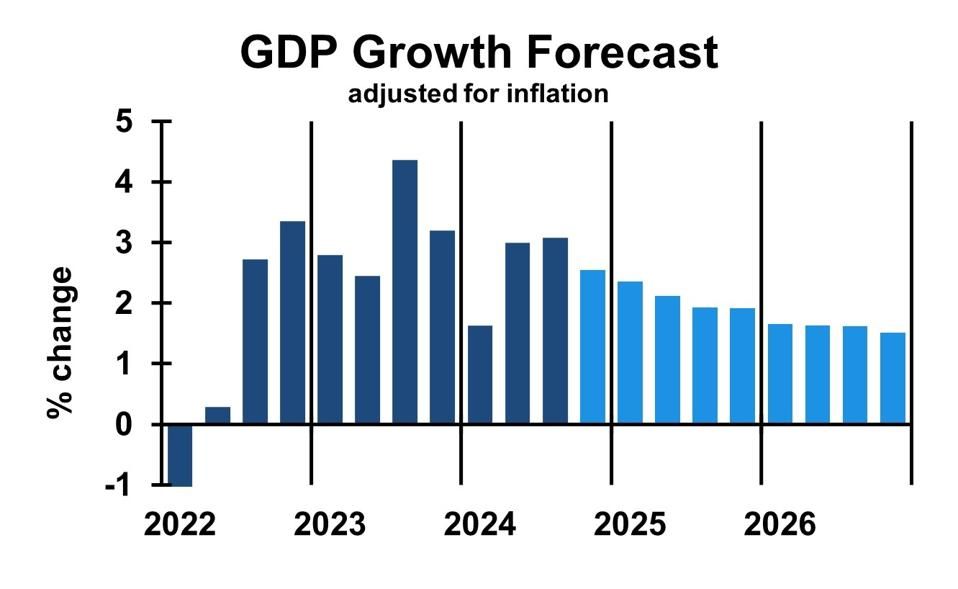

As trade tensions escalate, fears of a recession are rising. Goldman Sachs has increased the 12-month recession odds to 35%, citing concerns that the tariffs could slow down economic growth and increase inflationary pressures. The firm has also revised its GDP growth forecast to just 1% for 2025, indicating that economic expansion could be significantly hampered if the trade war continues.

Market analysts warn that continued uncertainty and higher costs for businesses may lead to job losses and reduced consumer spending. In an already fragile economic climate, an aggressive trade policy could push the U.S. economy closer to a downturn.

Given the current market volatility, financial advisors are emphasizing the importance of patience and diversification. Many are encouraging investors to focus on long-term strategies rather than reacting impulsively to short-term market swings.

Some experts suggest that investors consider defensive sectors such as utilities, healthcare, and consumer staples, which tend to be less sensitive to economic fluctuations. Additionally, holding a well-diversified portfolio can help mitigate risks associated with market turbulence.

With the tariff deadline approaching, all eyes are on Washington for further details regarding the scope and impact of the new policies. Investors, businesses, and policymakers alike are bracing for potential disruptions, hoping for clearer guidance on how trade relations will unfold in the coming months.

In the meantime, market watchers suggest staying informed, reviewing investment strategies, and preparing for possible volatility as the economic landscape continues to shift.

0 comments